Calculating a TAS Valuation

Calculating a TAS Valuation

In the first blog post in this series, we discussed the overall landscape of TAS M&A. This one discusses valuations and will take you a bit deeper into the metrics behind how buyer’s come up with their offering numbers. In the upcoming installment of our blog series, we will detail strategies that can improve your TAS valuation by as much as 25-40%.

Before going further, write down what you believe to be your company’s valuation.

Valuations for the Telephone Answering Service industry are done using the Market Approach. In this approach, the company’s competition and competitive landscape play a significant role in determining value. The market (or buyers) will use the historical selling prices of similar businesses to value the company.

When it comes to valuations of TAS, it’s a common misconception that valuation can be reduced to a simple equation involving monthly revenue and a fixed multiple. You’ve probably heard dozens of times that TAS trade at 10 or 12 times monthly recurring revenue and just left it at that. That may have been true a few years ago with the well-known strategic buyers, but with many exciting new buyers entering the market, unlocking the full value of TAS requires more than just an average of annual revenues.

This is Good News – valuations can be significantly better if you understand how to unlock the full value potential of your TAS before going to market.

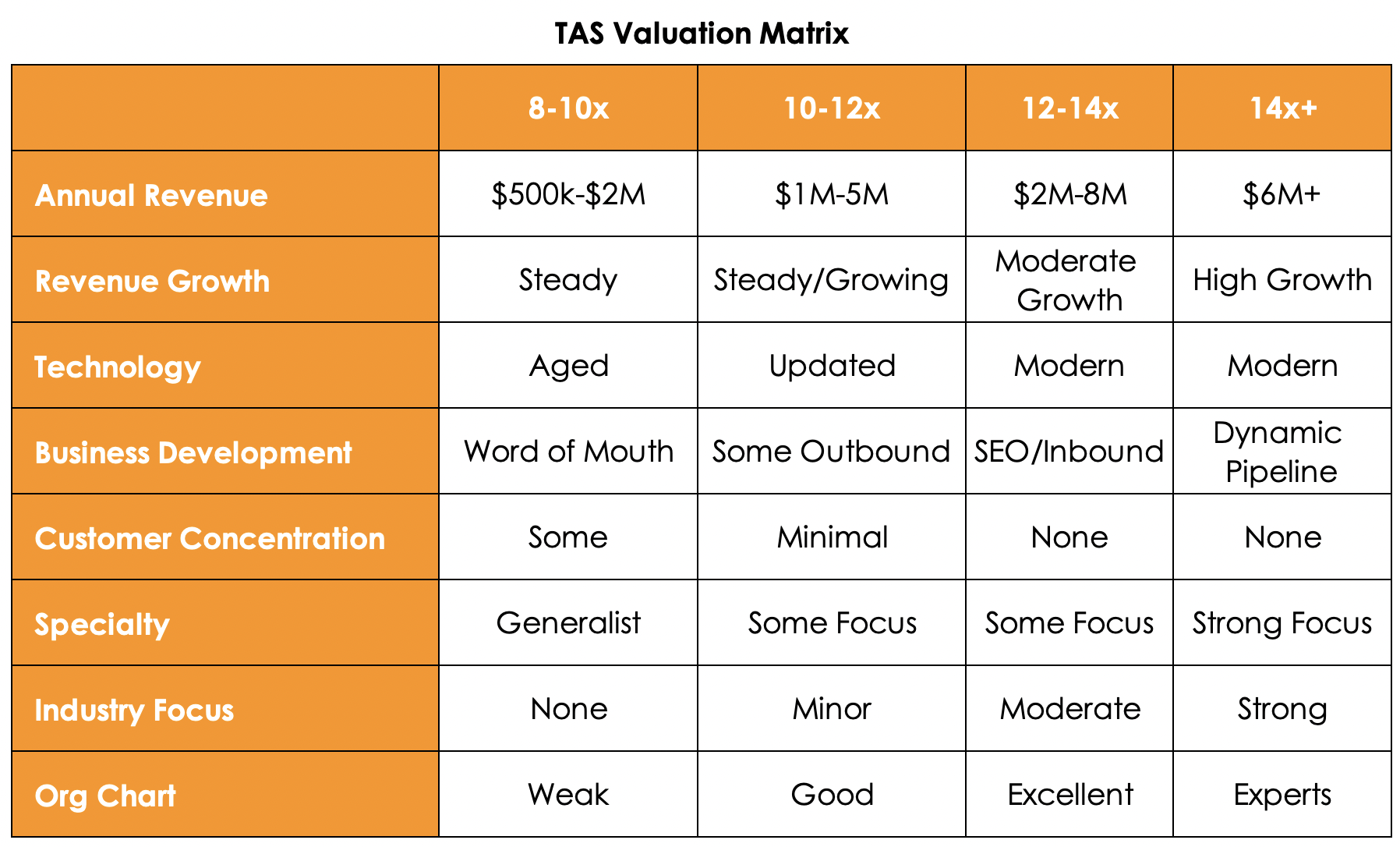

The matrix below can be used to proximate a starting valuation point. Down the left column are the characteristics that go into the valuation models of buyers. On the top are the multiples of average monthly revenue, which is the common method to determine TAS valuation. Take a few minutes to find out where your TAS is in this matrix.

Now match up your initial valuation with the one in the matrix. Likely, using this matrix had you questioning which multiple column you are in, and certainly gazing at the column to the right wondering how you can get into that one.

Let’s unpack each one of the characteristics and explain how these affect overall valuation.

Annual Revenue

Revenues greatly impact valuations, but it is not hard bound – in other words, firms of the same revenue size can exist in two or even three different multiple columns because not all revenue is created equal.

Revenue Growth

This is the first separator of valuation. To nobody’s surprise, buyers love growing firms. If a firm is growing at 10% per year, using the rule of 72, it will double in size in 7.2 years, but if it’s growing at 20% per year, it will double in 3.6 years. Buyers look for certain payback periods when determining value or price of a TAS target. The faster the payback period (which is how long it takes the buyer to recoup the investment, or price paid to the seller), the higher the valuation. This is not completely elastic, but all else being equal, a firm with significant growth will always command a premium over a company with stagnant revenues.

Technology

For most strategic buyers, the existing technology stack will be a minimal factor in total valuation. But, for the financial buyers (Private Equity and others), this may be significant if the target company (your TAS) is seen as either the first investment in the industry or one that will be used as a platform upon which to add other acquisitions. If you’re still using an on-premise solution, no problem, it will not negatively affect your valuation. If you’re on the most modern tech stack, it may attract more attention and potentially lead to a higher multiple.

Business Development

Like Technology, the depth of your new Business Development efforts will be less important with strategic buyers but vital to unlocking a higher multiple with financial buyers. Normally, a strong acumen in business development shows up in Revenue Growth numbers. If two TAS have the same revenue size, and all else is equal, the one with the stronger Business Development strategy will command a higher price.

Client Concentration

Customer concentration, or the extent to which a business relies on a small number of clients for its revenue, is a factor that can influence the value of a company. Whether customer concentration is high or low, buyers will interpret it in various ways, either as a positive or a negative.

When a business boasts low customer concentration, each individual client's contribution to the total revenue is relatively small on a percentage basis. This factor is viewed as a positive attribute. Low customer concentration spreads the risk associated with client departures. A business with a wide and diverse client base is perceived as having a more stable and resilient revenue stream. Buyers appreciate the predictability of income that comes with such diversity.

Conversely, high customer concentration, while not inherently negative, does introduce a level of risk that potential buyers must consider. The risk associated with client departures is significant. If one or more of these major clients were to leave, a substantial drop in revenue would materially affect profit. To account for the elevated risk, buyers will often lower the valuation, and may adjust the sale terms to compensate for financial impacts of client departures by using an earn-out. But, if the large clients are named brands, and desirable to the specific buyer, it may be an attractant rather than a repellent.

Specialty / Industry Concentration

Much like customer concentration, buyers may have varying appetites for the types of industries that a TAS focuses on, and their preferences play a significant role in the valuation of such businesses. Specialty is the degree to which a firm has unique expertise in delivering service that is unique to an industry. For instance, is the TAS HIPPA compliant, PCI compliant, SOC2 Type 2? Then it enjoys a specialty. Industry Focus is the characteristic that defines how revenues are distributed within the various client industries the TAS services.

Most buyers don’t have a specific industry preference when it comes to acquisitions. They recognize the value in a broad spectrum of industries, ranging from trades like plumbing or electrician to specialized fields like medical or funeral homes. A TAS that serves a wide range of industries is appealing because it provides built-in diversification, which mitigates risk associated with an industry specific economic downturn. Buyers of this category prioritize the flexibility and risk management that come with a broad industry range.

On the other hand, there are buyers who seek a more specialized focus when it comes to industry concentration. Answering services that have a well-defined customer base centered around one specific industry, with healthcare and legal being two of the most sought-after sectors, can be particularly attractive. Such buyers often view industry-specific experience and a dedicated customer roster as invaluable assets. In these cases, the buyer's specific industry focus allows businesses with aligned customer bases to command a higher multiple in valuation.

Organizational Chart

In many closely held businesses, it's a common scenario where the owner is also the rainmaker. While this level of involvement can reflect the owner's dedication and commitment, it can also pose a significant challenge when it comes to transitioning the business to a buyer. For potential buyers, the ideal scenario is to acquire a business in which the operational framework and org chart can seamlessly run without owner involvement.

At Kommit & Company, we've developed the P.A.C.T. acronym to help owners identify the key people that buyers need post-closing.

- P: People and Process: responsible for service delivery, HR, training, and staffing.

- A: Accounting: bookkeeping, invoicing, payables, payroll, and accounting reports.

- C: Clients: managing client relationships, sales, client reporting, and marketing.

- T: Technology: all IT and IS utilized to deliver client services.

A full PACT team will help you realize full value upon exit as the potential buyer has reduced risk because these key areas will be seamlessly managed through the transaction and beyond. Org charts with holes that are created by owner departure may lower valuation or require an owner staying on through a longer transition.

Conclusion

There are several factors that go into valuating TAS companies. Certainly, the matrix above will get your gears turning on where you are versus where you want to be in terms of value. We often work with companies who want to make changes in preparation of an exit two or three years in the future. This matrix is where we start formulating a plan for owners to identify weaknesses and turn them into strengths.

As a business owner, knowing your valuation is important. For most small business owners, their company is the largest single asset they will ever own in their lifetime. And it can be the riskiest.

In the upcoming installment of our blog series, we will give you strategies that can improve your TAS valuation by as much as 25-40%.