Shifting from Expenses to Revenue: Transforming Your Business for Success

WHATEVER YOU DO, MIGRATE FROM THE EXPENSE SIDE OF THE EQUATION TO THE REVENUE SIDE!

WHATEVER YOU DO, MIGRATE FROM THE EXPENSE SIDE OF THE EQUATION TO THE REVENUE SIDE!

Unlocking Your Full TAS Valuation

In our line of work, we often guide clients through transactions culminating in joyous celebrations and resounding appreciation. However, the journey doesn't always proceed smoothly. Even the best transactions have setbacks. On occasion, one transaction may have several.

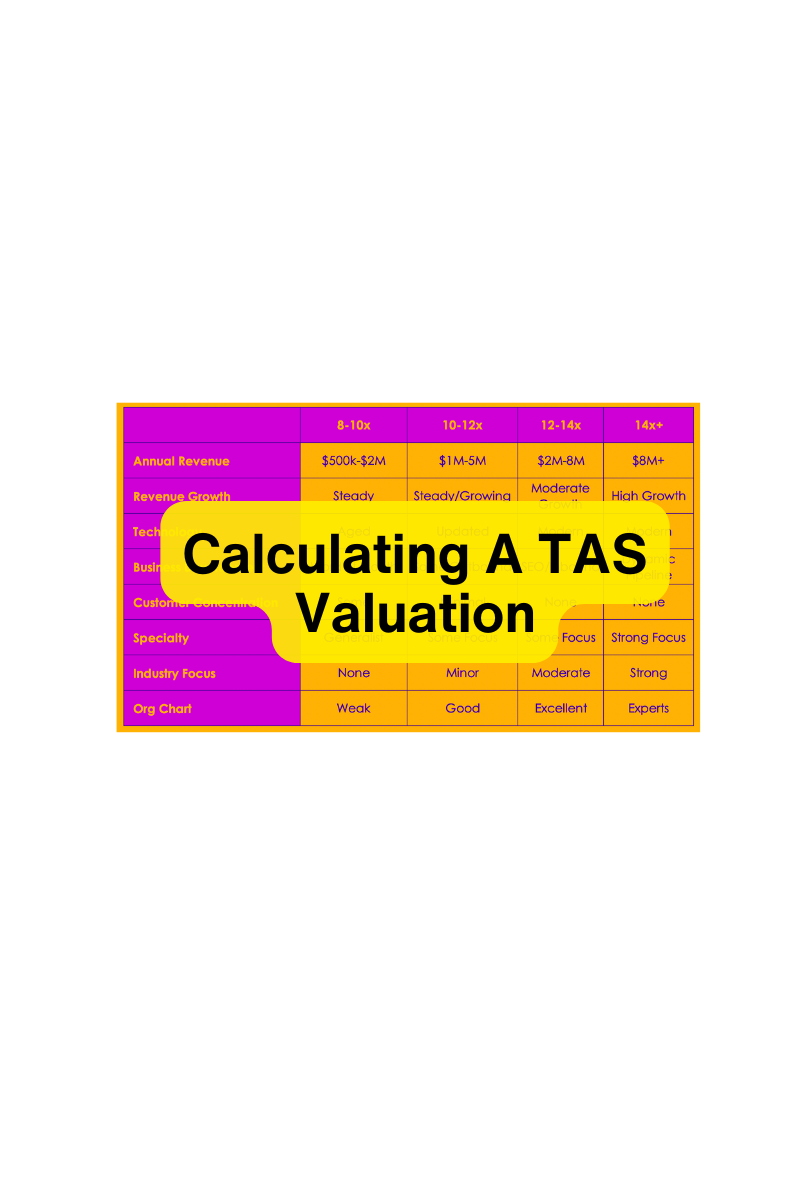

Calculating a TAS Valuation

Someone asked the other day how I got into M&A, and here's my story. I was working at a marketing agency in 1989 when our client, AT&T, wanted a sales agency to sell the advertising in the AT&T 800 Directory. The agency decided to pass on the opportunity, and I asked the owner of the agency I worked for if I could go after the business.

Recently, we received a call from a potential buyer within our industry, inquiring about our assistance acquiring several answering services. After careful deliberation, we made a strategic decision that will more closely align us with the interests of owners in the answering service industry. We chose not to offer buy-side services, and here's why:

Richard joined Jason Cutter on the Authentic Persuasion Show podcast. Great conversation on how contact center owners can scale, optimize, and ultimately increase the enterprise's value. As a former call center owner, Richard tells his story on founding, growing, and ultimately exiting his center. Learn from his story and feel free to reach out to learn more.

Designed to result in a positive exit experience.

Writing an exit strategy is only effective if it centers around the owner’s goals. From determining how long...

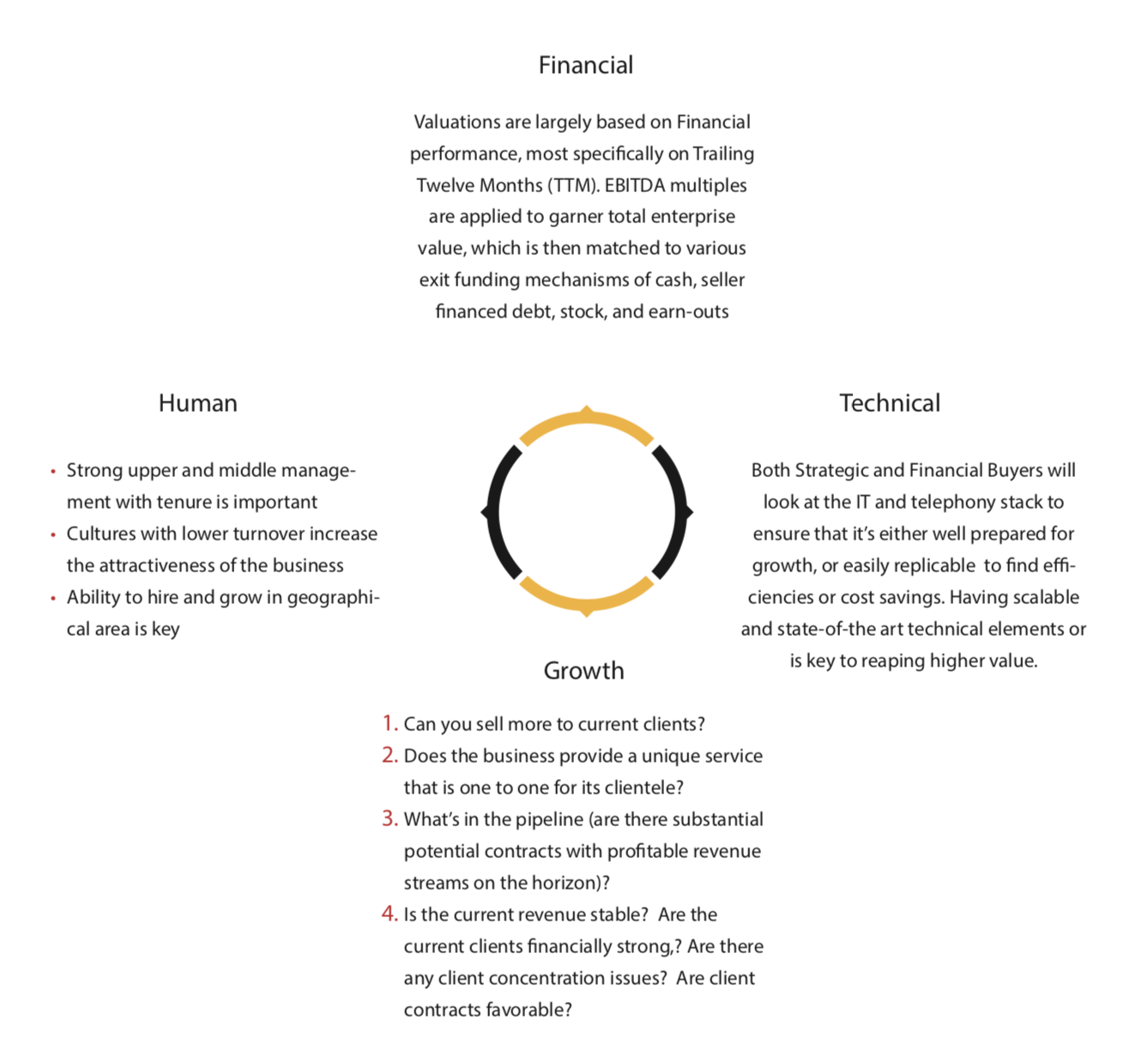

Valuations for call center / BPOs will vary depending on a large set of variables, but typically they come down to these 4 areas. Buyers want to know that the past success is not only repeatable but can be improved upon with gains in efficiencies, reduction in costs, and improvements to revenues.

** updated post with SBA changes on 4/2**

As of 4:00pm ET on 4/2, the SBA and participating lenders are planning on going live with the PPP tomorrow, 4/3. However, final guidance to banks has not been sent but has been promised by midnight tonight. Because of the high possibility of fraud, banks may choose to service current customers first, non-customer but known businesses next, and finally unknown businesses last. Therefore, we recommend you apply for the PPP loan with your current bank or financial institution.

A sample application for Payroll Protection Program can be found by clicking here

In the recent Coronavirus, Relief, and Economic Security (CARES) Act signed into law is $349B set aside for Small Business loans. Many call center and BPO owners have faced significant loss of business due to a myriad of effects the virus has caused to revenue streams, remote work capability, and loss of brick and mortar facilities to stay at home orders. This post will outline the key points of SBA's loan programs available and gives you resources to learn about and links to apply for loans.