Selling Your TAS for the Highest Price + BONUS: Free 2024 Marketing Idea That Will Fill Your Pipeline

Unlocking Your Full TAS Valuation

In the first blog post in this series, we discussed the overall landscape of TAS M&A. The second one discussed valuations and took you a bit deeper into the metrics behind how buyers come up with their offering numbers. In this installment, we will detail strategies to improve your TAS valuation by 25-40%.

Quick Review of How TAS are Valued

Valuations for the Telephone Answering Service industry are done using the Market Approach. In this approach, the company's competition and competitive landscape play a significant role in determining value. The market (or buyers) will use the historical selling prices of similar businesses to value the company.

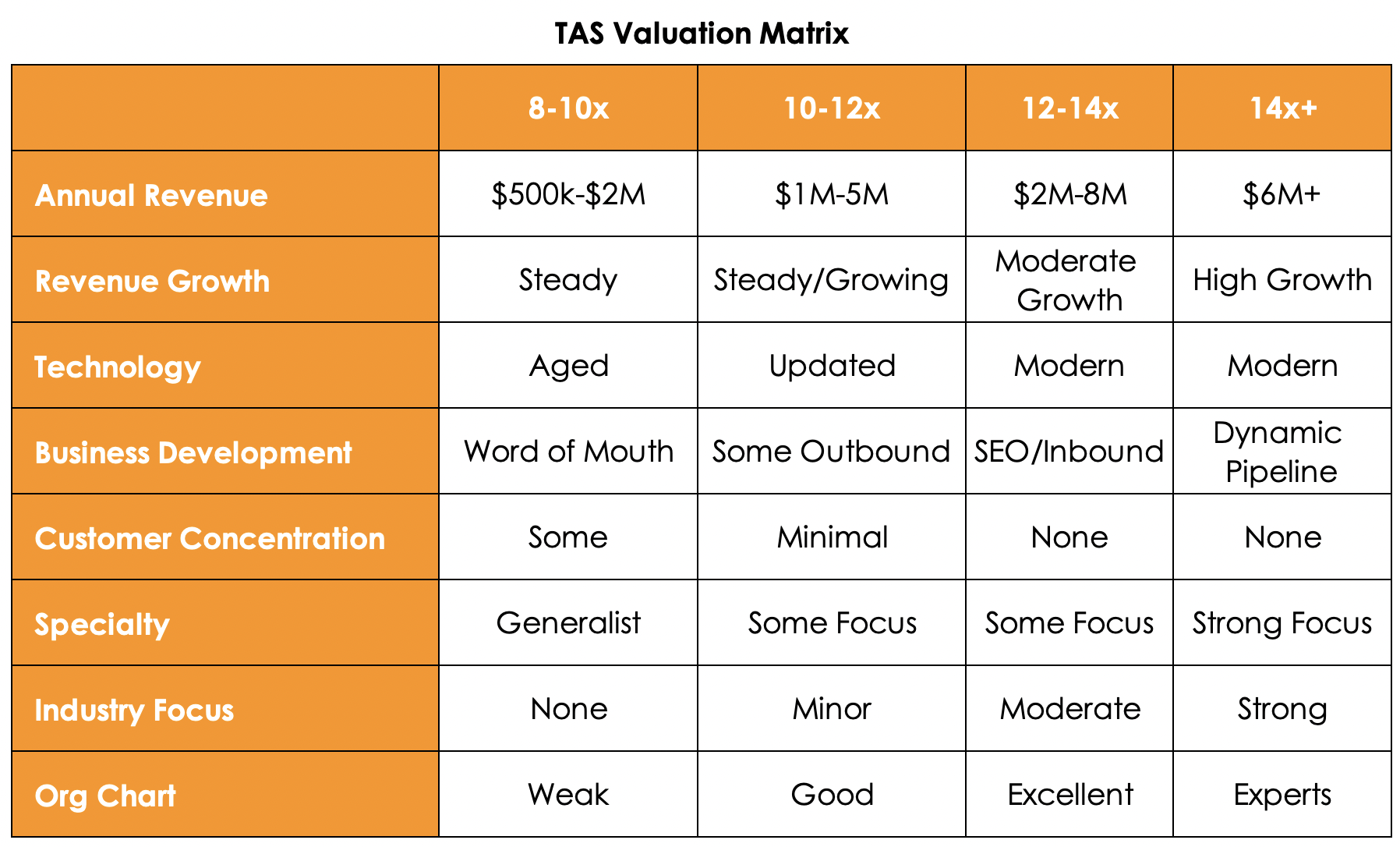

The matrix below can be used to proximate a starting valuation point. Down the left column are the characteristics that go into the valuation models of buyers. On the top are the multiples of average monthly revenue, the common method to determine TAS valuation.

These valuations have been the standard for years. Visiting the Connections Magazine archives will find many references to similar valuation techniques and examples. But let's look deeper at these models and discover why they are outdated and may limit a TAS valuation at exit.

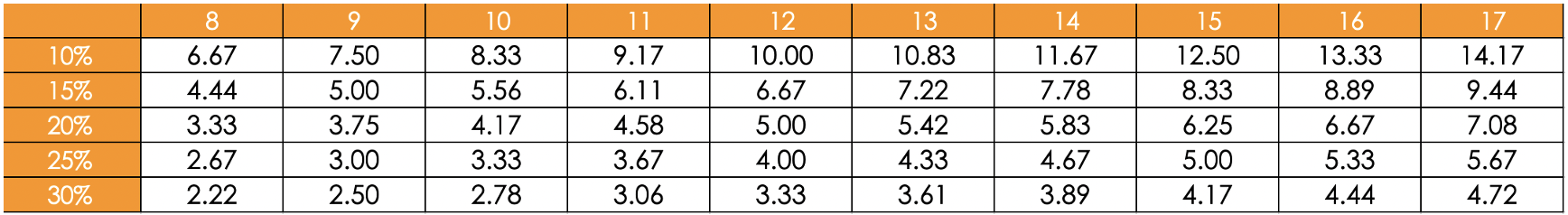

The matrix below shows a multiple of the Adjusted EBITA ratio by locating the firm's Adj. EBITDA percentage on the vertical axis and the traditional monthly revenue multiple on the horizontal. Most firms outside of TAS trade on a multiple of Adj. EBITDA. Buyers will be comfortable paying between 4-6x for an average firm, but would pay over 8x for a stellar firm. Find your Adj. EBITDA margin and scan across to where the Adj. EBITDA multiple is between 4.5-6. Then find the monthly multiple at the top. Does that match your initial expectations?

If you recall, one of the more critical characteristics to buyers is the payback period. We highlighted an example in the previous post that showed why a firm with 10% profit is less exciting than a firm with 20%. Using the old methodology, you will see that two firms with these two profit margins should trade differently but often don't. Let's assume both firms fall under the 12x monthly multiple. Firm A has 10% Adj. EBITDA while firm B has 30%. You will see that the price of firm A is 10x Adj EBITDA, and firm B is at 3.33x. Firm A reaps the benefit of an outdated method while firm B leaves lots of money on the table.

Key takeaway:

Understanding EBITDA multiples is the first step in unlocking your real value at exit. If you're a TAS with higher than average profit (or Adj. EBITDA), the old method of calculating price will force you to leave money on the table. Buyers will pay upwards of 5.5-7x for highly profitable firms, which, as you see in the matrix above, leads to far higher monthly revenue multiples than the old valuation method.

Conversely, if you're a lower than average TAS in terms of profit and want to consider an exit, utilize every tool at your disposal in the year or two before exit to maximize Adj. EBITDA. Typically, a buyer will focus most heavily on the trailing twelve months (TTM) before exit, so you still have time to optimize and realize your full value on exit if you start today and exit in 12-18 months.

Clean Financials

This element of a successful exit cannot be highlighted enough. Clean financials are another key to unlocking full valuation. The tax code incentivizes entrepreneurs to show the lowest possible Net Income year after year. But when it comes time to exit, we need to show the highest possible profit to maximize the selling price. Work with your bookkeeping and accounting team to separate, as much as possible, the true expenses of the firm and your personal, or discretionary, spending. These elements are called add backs and are vital to setting the net Adj. EBITDA that valuations are based on.

Market Wages & Market Prices

Buyers will want a firm that shows a profit while paying market wages to the staff. If your wages are below market, then profitability is higher than will be anticipated after the buyer brings wages up to market level. Comparatively, if it's been five years since your last price increase, buyers will see this as a heightened risk that client departures are imminent post-close during a price increase. Before exiting, ensure you can offer analysis and explanation in these two areas and raise wages and prices to market level well before hitting the market. It's easier said than done, but if you want to get full price, it's a big value driver in a buyer's mindset.

PACT Team

We reviewed this characteristic in the previous blog, but full price is always more attainable when owner dependence is closest to zero as possible. The nearer you are to exit, the less dependence your firm should have on you. Period. Grow leaders internally or hire externally to replace your contributions, whether they be in sales, marketing, operations, HR, accounting, or whatever. This widens the potential buyer field and yields a higher selling price every time.

Healthy Pipeline

Buyers love growing firms. If your TAS has consistent revenue growth, you can capture a higher exit multiple. If your pipeline could be more active or revenue retreating, consider revamping your customer acquisition process before a sale. Many resources out there detail successful methodologies, and here's one from a while back from Donna West that is excellent Also, we have a bonus idea below that may help you kickstart a marketing plan for your TAS.

Competitive Bidding Process

The number one determinant to achieving the highest selling price, by far, is the competitive bidding situation. Having one buyer is akin to having no buyers. You will only be negotiating against yourself, plus you may find that you don't like the buyer by the time closing comes around. Get competitive offers, find the proper suitor (hopefully the highest price), and then negotiate every detail until closing.

Transactions are incredibly time-consuming and can be a very emotional experience. Utilizing a sell-side advisor has been shown to deliver the highest price but also increases (by a factor of 4) the chances of the transaction closing.

Sellers who use an intermediary are:

- 87% more likely to hit their exit goals

- 90% more likely to surpass the desired valuation and achieve a

- 125-140% sale price versus going it alone.

Summary

Your TAS is likely one of the largest assets you will ever own in your lifetime, and you can only sell it once. When it comes time to cash out, use the tips above and get ALL the money off the table. Using a sell-side advisor has shown to be the single most effective way to unlocking the full valuation of a business at time of sale. Feel free to reach out to us to have a conversation about your exit plans, and we will guide you on. a strategy that gets all of the money off the table when it's your time to sell.

BONUS: How to Supercharge Your Biz Dev Efforts in 2024

Increasing Sales and Improving Business Position

As an answering service owner, you possess untapped sales potential within your office. Your agents, skilled in telephone interactions and eager to engage with potential clients, can become your invaluable sales force. Why not utilize the current employee base to drive a new pipeline of clients and supercharge morale along the way?

Here's the innovative approach: offer your agents an optional opportunity to generate leads. For every new account they bring on, reward them with a percentage share of the revenue, for as long as the client is onboard. You create the script, find a list of leads, and ask your agents to make warm calls during slow times during the day. The offer can include free minutes to potential clients to allow them to try your service and appreciate the difference your services can make.

A sample approach would be, "Hi, my name is Eric, and I wanted to provide you with a sample of the high-quality voice services we provide at Acme Answering. If you're like most businesses, you lose clients and money in your voicemail. After trying us for three months, I think you'll find our live voice services will make you more money than they will cost."

A team of 20 agents making just one call per day can reach over 5,000 leads in one year.

This approach enables your agents to increase their earnings and establishes a sustainable sales pipeline, ultimately driving substantial growth in your overall revenue. Over time, a full pipeline and increased revenue will enhance your business's value and improve the deal structure in your favor.

You can find lists of new leads by using a service like D&B Hoover's, which is under $2,000 per year and offers up to 5,000 downloads. If your firm likes home services, run a list of contacts of HVAC or plumbers in your service area. You can download the list into Excel and run the campaign from there. Or you can beef up the campaign by adding the contacts into a CRM and adding them to an automated dialer (watch the regulations) or mass email service.

This campaign is easy to start and will rejuvenate your marketing efforts and likely add much-needed employee morale, especially when paired with a contest or revenue-sharing program.