Determining Value of a Call Center / BPO

The Long Explanation of Pricing in Call Center / BPO M&A

Each call center will have it’s own unique DNA, so this formula explanation is not a blanket for all centers but rather a general overview of how price is determined. Buyers are looking for balanced, heal- thy businesses that will grow over the short term (3-5 years), and allow them to position for another exit down the road. There are buyers for underperforming call centers as well, although those formulas are less able to be described in short as they are more situational and either relationship, geography, or client based in nature.

Of all the characteristics and metrics a Buyer will review when determining a purchase price, EBITDA (Earnings before Interest, Taxes, Depreciation & Amortization) is perhaps the most important.

The call center M&A market works o of Adjusted EBITDA, which removes an owner’s discretionary spending (excess compensation or expenses) and explainable one-time events or pro-forma adjustments applied to previous years presented for recent material expense savings (i.e. telephony costs), as buyers will not bear these costs after acquisition. For the most part, Adjusted EBITDA for the trailing twelve months (TTM) will be most important metric, but buyers will want to see how the company has delivered EBITDA over the last 3-4 years. Prices are typically a multiple of EBITDA.

This is one measure of the health of a business, and the singular most important when determining price

Determining a multiple of EBITDA requires an examination of the longevity and history of the business, it’s revenue and pro t volatility, strength of client contracts, client concentration, growth prospects, geography, people (management), and technology. Buyers will pay more for a business that has a long and steady history of profitability. Additionally, if the client roster is filled with long term, name brand clients, the value goes up. Client concentration is a key factor, as too much revenue from too few clients can lead to unpredictability and higher risk which drives prices down. Growth prospects are important — having a strong pipeline will certainly lead to a higher valuation. Geography can be important, especially if the buyers want to diversify their footprint, or are avoiding certain lo- cations based on employment issues. A strong management team, both upper and middle, are important, especially for a buyer that wants to keep the business as is and run it as an investment. Technology is becoming less and less of an issue, due in large part to cloud based platforms that are easily portable and scalable.

EBITDA Multiples Explained

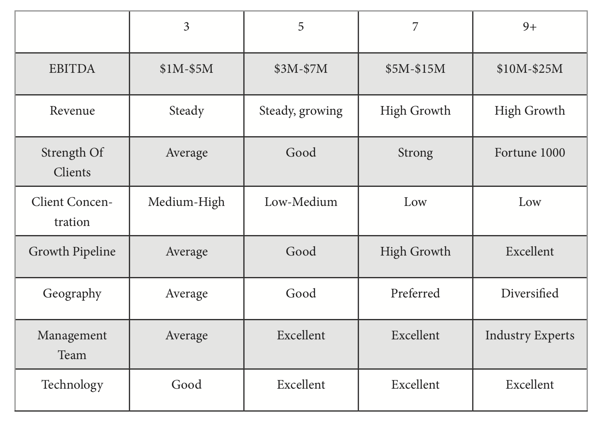

In the chart below, a range of multiples will be illustrated by characteristic. Each deal is unique, much as your business is guaranteed to be different than your competition. Buyers mainly look for these are- as when determining value; however, unique traits such as favorable geography, key clients, or one-of-a

kind service offering can certainly improve valuation. Buyers may value a call center differently as well, as a financial buyer may look at a shorter term for return on investment than a strategic buyer. Valuation may also be affected by the types of funding mechanisms used in the exit, with cash lowering a multiple and stock, debt, or earn outs increasing overall returns.

In our experience, the key to success in finding the highest valuation is to prepare an exit strategy that optimizes the business, builds an attractive story around the company’s past and future, prepares extensive financial and operational reporting, and then when taken to market creates a bidding war between multiple buyers competing to acquire the business on the owner’s terms.